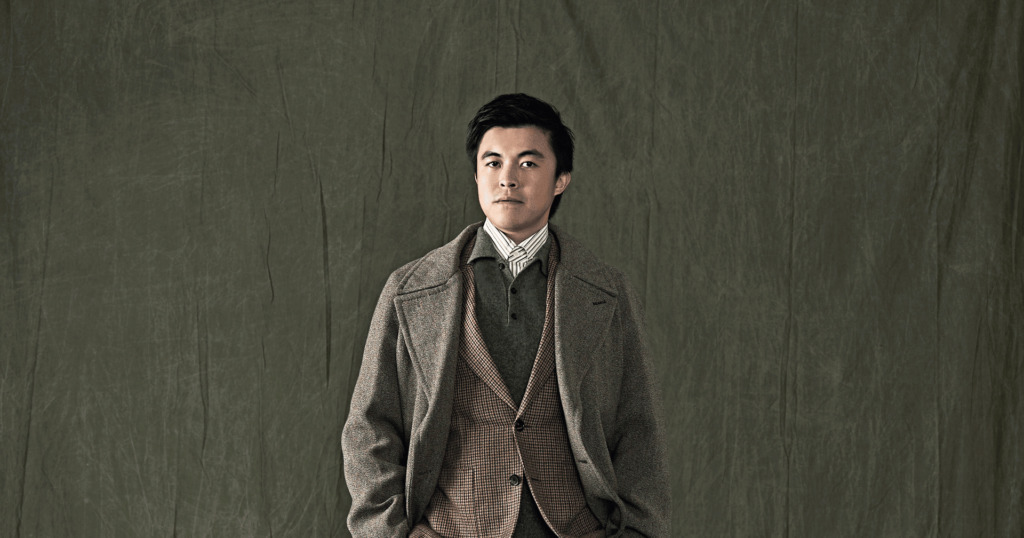

Timah Partners is in talks with three companies for possible acquisitions as the newly launched firm doubles down on supporting Singapore’s small and medium-sized enterprises, said founder and CEO Dennis Chua.

Singapore-headquartered Timah, which was officially launched last week after raising USD 50m in a Series A round, is hoping to add one company to its portfolio this year, before ramping up its pace of acquisitions in the following years, added Chua.

Describing itself as a permanent holding company, Timah was established to acquire Singaporean SMEs whose owners are ready to retire but don’t have a succession plan. Chua said Timah plans to take majority stakes or full control of companies and hold them as a strategic owner, setting itself apart from traditional private equity firms.

Timah will target SMEs with revenues of SGD 10m to SGD 50m (USD 7m to USD 37m), with EBITDA of SGD 2m to SGD 10m or net profits of SGD 1.5m to SGD 8m, according to its website.

Targets need to be asset-light and have a business-to-business model with recurring revenues, said Chua. Timah is holding conversations directly with potential targets, but is open to approaches from advisers.

Timah’s initial focus is on Singapore, but it is hoping to expand to Southeast Asia over the longer term, said Chua. It is planning to write checks of SGD 10m to SGD 70m per acquisition, which may be too small for typical private equity or too large for venture capital.

Focus sectors include commercial air conditioning servicing and maintenance companies, commercial roofing and landscaping, maritime and port services, commercial laundry and hygiene services, commercial private security and asset protection, waste management and recycling, fire protection and safety, and freight forwarding, according to its website.

Debt in portfolio mix

Timah’s Series A investors included the founders of iconic global holding companies like Danaher, TransDigm and 3G Capital; senior leaders from local firms such as Grab, DBS Bank, Union Gas, and QuantEdge; and public figures like a former Singaporean politician and head of regulatory agencies, as per its press release.

No single shareholder controls the company, said Chua, adding that its investors are providing permanent capital to Timah. The firm does not intend to exit any asset it acquires for distributions, but its investors have the option for liquidity through secondary sales in the future, explained Chua.

Timah won’t have to raise capital to replace but would tap investors again if high-quality acquisitions come faster than expected, said Chua. He noted that Timah’s future capital could come from the cash flows of its acquired companies.

In addition to equity, Timah is open to using debt to fund acquisitions. Chua noted Singapore’s fixed income yield is very low. Once Timah closes its first few acquisitions, it may consider bundling the portfolio companies’ debts for family offices and wealthy investors, said Chua. These would yield higher interest for investors, comprising higher quality businesses with meaningful cash flow, and Timah will sit junior to the creditors, he added.

“It would be a recurring debt offering on a cash-flowing, high-quality business where Timah takes all the equity risk before the debtholders lose their first dollar,” said Chua. “Our debt will be at a yield that is double that of what people are getting anywhere else in the SGD-denominated space. It’s a huge gap in the Singapore market right now.”

Solving problems

Chua founded Timah to address two problems in Singapore: that of talent and succession.

“SME owners like the permanence of what we are doing because they care about legacy,” he said, adding that they care about where their customers and staff end up even after exiting.

In Singapore, SMEs employ more than 70% of the city’s workforce. The population aged 65 and above is set to double in the next two decades, but many SMEs lack a well-laid-out succession plan due to a talent shortage.

Timah’s ownership will play a major role as it will launch a CEO-in-Training programme to develop C-suite leaders within its portfolio companies.

“By merging this ownership and leadership model, we can create a sustainable and long-term solution for SMEs in the region,” said Chua.