Singapore, 7 August 2025 — Timah Partners, Singapore’s first permanent holding company built to address Southeast Asia’s SME succession crisis, today announced the appointment of Kelvin Ho as the inaugural candidate in its CEO Succession Program (CSP).

Ho’s appointment marks a foundational milestone in Timah’s mission to close the region’s longstanding SME succession gap. Anchored by the launch of Southeast Asia’s first dedicated CEO program for SMEs, Ho is the first to join the key initiative that will develop a new generation of business leaders capable of stewarding enduring SMEs over the long term while preserving their legacies.

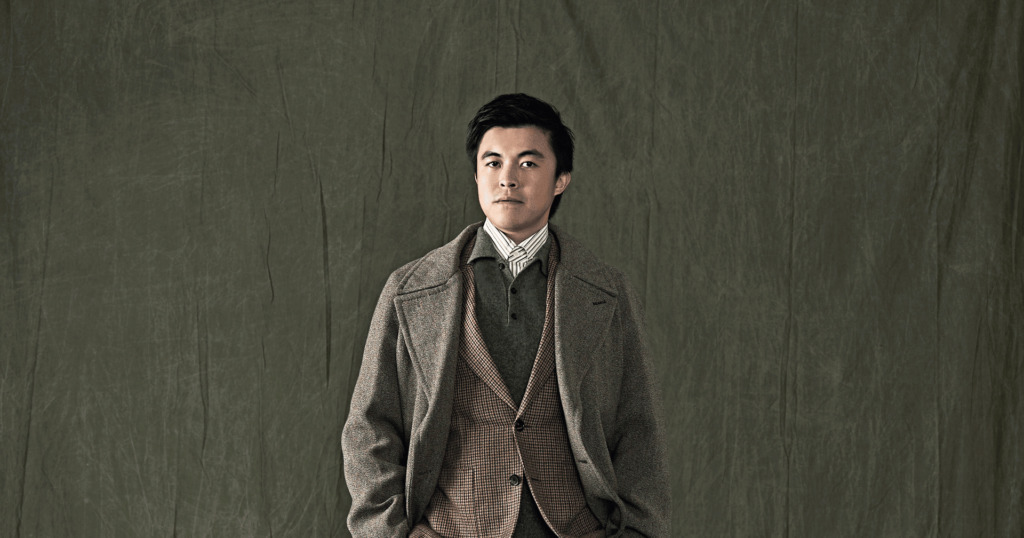

Ho, 44, brings nearly two decades of experience in operations, commercial strategy, and early-stage company building across Southeast Asia, China, and the U.S. He was most recently Head of Business at EVYD Technology, and previously held senior leadership roles at Singapore’s Economic Development Board (EDB), Swiss Re, and MiRXES.

An entrepreneur at heart, Ho has also founded mission-driven organisations and held leadership roles across a range of nonprofits focused on healthcare access, social enterprise, and small business support. His decision to join Timah reflects a deep belief in the role of SMEs as engines of economic resilience, and a personal commitment to building businesses that combine operational excellence, long-term thinking, and enduring impact to make a difference in society.

Ho holds an MBA from UCLA Anderson and a B.Sc. in Biomedical Engineering from Duke University.

“I’m a firm believer in strong businesses as a way to build meaningful, lasting impact in society,” said Kelvin Ho, Timah Partners’ inaugural CSP candidate. “Joining Timah’s CSP is an opportunity for me to demonstrate that not just as an operator, but as a long-term steward of a company’s next chapter.”

A peek behind Southeast Asia’s first SME CEO succession program

With his appointment, Ho becomes the first business leader to go through Southeast Asia’s first structured CEO program for SME succession.

Following a vetting process that involves multiple rounds of interviews, case study assignments, and extensive reference checks, successful CSP candidates undergo a multi-stage journey that takes up to three years to complete, beginning with M&A exposure at the holding company level, followed by operational apprenticeship under a sitting CEO, and culminating in full business leadership where they will take over the reins of a high-quality B2B SME.

“Kelvin embodies the grounded, values-driven, long-term oriented leadership that SMEs in Singapore want and need, and that we seek to develop at Timah,” said Dennis Chua, Founder and CEO of Timah Partners. “As the region’s first CSP candidate, he sets the tone for the kind of operational talent we believe will meaningfully transform SME continuity across Southeast Asia.”

CSP candidates receive competitive compensation, full benefits, and a clear line-of-sight to the CEO seat, de-risking the transition to SME leadership. Equity ownership also provides a long-term path to wealth creation, while a decentralised, high-autonomy model ensures candidates have the freedom to lead while benefiting from central support.

Candidates also gain access to Timah’s world-class board and advisory group, which includes current and former leaders from DBS, JTC Corporation, the Singapore Land Authority (SLA), Grab, Quantedge, Union Energy, and a former elected Member of Parliament. Combined with Timah’s permanent capital base, this gives CSP candidates the space and resources to build for the long term, free from short-term exit pressure.

Buying and not selling—a new way to create value

Unlike private equity or search funds that have sprung up in recent years to buy and flip SMEs through financial engineering and short-term exits, Timah Partners pioneers an entirely different capital model in Southeast Asia—the permanent holding company—that combines long-term capital with talent development and business stewardship, solving Singapore’s SME succession crisis without dismantling hard-fought SME legacies.

Timah Partners acquires high-quality, essential, recurring-revenue B2B businesses in the S$2–10 million EBITDA range. Examples of these businesses include MSP and IT services, facilities management, and waste management, to name a few. Timah prioritises businesses with predictable revenues, low churn, and within fragmented markets ripe for consolidation.

Ho’s appointment follows Timah Partners’ US$50 million Series A round in June 2025, securing the backing of the founders of iconic holding companies like TransDigm, Danaher, and 3G Capital, as well as veteran investors from top-tier investment firms such as Insight Partners, Norwest, TCV, and Tiger Global.